Yamaha claimed the largest market share in off-road motorcycle sales, selling a total of 6170, up 49,2% compared to the same period last year. Honda was second, having sold 5497 motorcycles, up 31.4%. KTM was third with 3338, an increase of 36.6%.

Kawasaki experienced the highest growth in the off-road segment, increasing its sales by 72.8% over last year bringing its tally to 3099.

Husqvarna was a strong performer, up 59.8% from last year while Suzuki grew its sales by 8.5%.

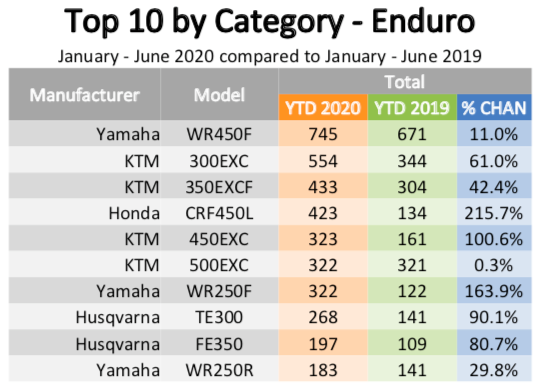

The Yamaha WR450F was the best-selling enduro bike. Yamaha recorded 745 WR450F sales, which represents an increase of 11% from last year. The WR450F’s growth is somewhat overshadowed by the jump in sales of its competitors. KTM’s 300EXC TPI posted a 61% increase in sales (554 units). The KTM 350EXC-F jumped by 42.4% (433 units) and the Honda CRF450L saw a 215.7% sales increase, from 134 to 423.

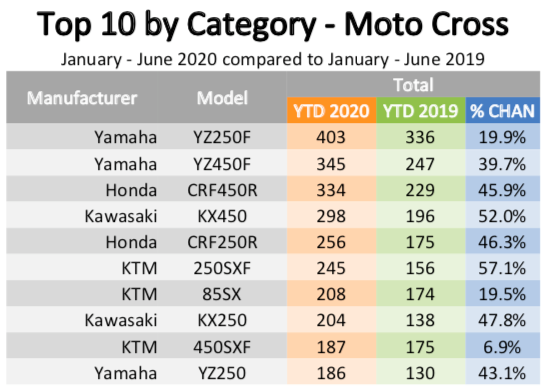

The YZ250F and YZ450F owned first and second in the motocross category, respectively. The 250F increased its sales by 19.9% (403 units), the 450F 39.7% (345 units). Honda’s CRF450R also experienced strong growth, up 45.9% (334 units). The Kawasaki KX450 was one of the most improved, up 52% (298 units).

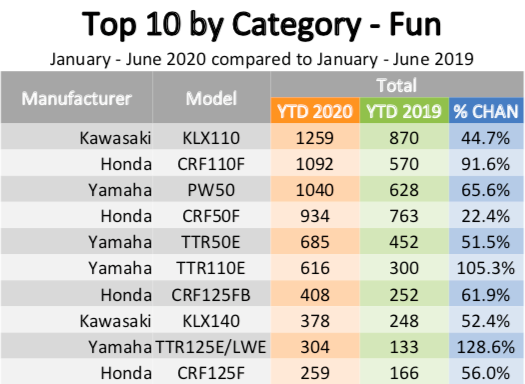

In the Fun Bike category, it was a feeding frenzy on showroom floors. Kawasaki’s KLX110 up 44.7%, Honda’s CRF110F up 91.6% and even the PW50 improved on its impressive track record, posting a 65.6% increase.

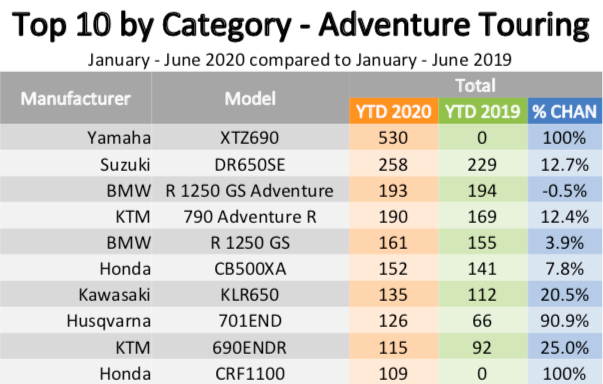

Yamaha’s new XTZ690 Ténéré outsold its adventure rivals by more than double. 530 XTZ690s were sold in the first half of the year, more than double second in category, the Suzuki DR650SE, with 258 sold.

Overall, a total of 52,838 motorcycle sales were recorded from January to June 2020, in comparison to 42,457 during the same period in 2019. This represents a strong 24.5 per cent increase in sales, a bright spot in an economic environment that has been predominantly negative over the past four months.

Tony Weber, chief executive of the FCAI, welcomed the positive sales results.

“It is wonderful to see some strong sales from our member motorcycle brands,” Mr Weber said. “A year-on-year increase of 24.5 per cent is significant, and signals improving conditions for both members and dealers,” Mr Weber said.

The most popular segment during the half was the ATV and SSV segment, with a total of 14,545 sales compared to 9,638 sales in the first half of 2019. Off-Road motorcycles reported 20,885 sales in the half-year, compared to 14,666 in the same period 2019.

“The ATV and SSV segment is up a remarkable 50.9 per cent and now represents 27.5 per cent of the total market. And off-road bikes are also on fire, with an increase of 42.4 per cent, and claiming 39.5 per cent of the total market,” Mr Weber said.

The popularity of these two segments are thought to be a direct result of the COVID- 19 pandemic. Tony Weber explained:

“People can’t go for overseas holidays, and for quite some time, they couldn’t even go for holidays within Australia. So, we believe that, instead of spending up big on expensive family vacations, people are treating themselves in different ways – and this could mean they are taking up new sports like trail bike riding.

“ATVs and SSVs are also popular, and we understand this is due to the Government’s instant asset write-off program which makes the purchase of farm machinery and equipment very attractive at the present time,” Mr Weber said.

Road bikes and Scooters did not enjoy the same increase in popularity as the previous two categories. Road bikes reported 15,243 sales during the first half, down 2.7 per cent on the same period last year. Scooters recorded 2,166 sales, down 12.8 per cent, for the first half of 2020.

Honda claimed the top spot YTD reporting, 12,563 sales for a 23.8 per cent market share, followed by Yamaha with 12,344 sales for 23.4 per cent share, Kawasaki with 6,545 sales for 12.4 per cent share, KTM with 4,391 sales for 8.3 per cent share and finally Suzuki with 3,594 sales for 6.8 per cent market share.